Meta shares surge after profit boost

The owner of Facebook and Instagram has announced its first dividend after better-than-expected fourth-quarter results, sending its shares sharply higher.

Meta Platforms, which also owns WhatsApp and Threads, a rival to Twitter/X, reported that revenues rose 25 per cent to $40.1 billion for the three months to the end of December. Analysts were expecting revenues of $39.2 billion.

The company announced a dividend of 50 cents a share and an additional $50 billion share buyback as profit rose to $10.6 billion in the quarter from $300 million a year earlier.

The technology giant forecast first-quarter revenues of $34.5 billion to $37 billion, above Wall Street expectations of $33.8 billion. It expected total expenses for this year to be unchanged at $94 billion to $99 billion.

Meta said that advertising impressions, or views, increased 21 per cent from a year earlier and that the average price per advert rose by 2 per cent.

Facebook reported 2.11 billion daily active users on average for December, an increase of 6 per cent year on year, while monthly active users stood at 3.07 billion — a rise of 3 per cent.

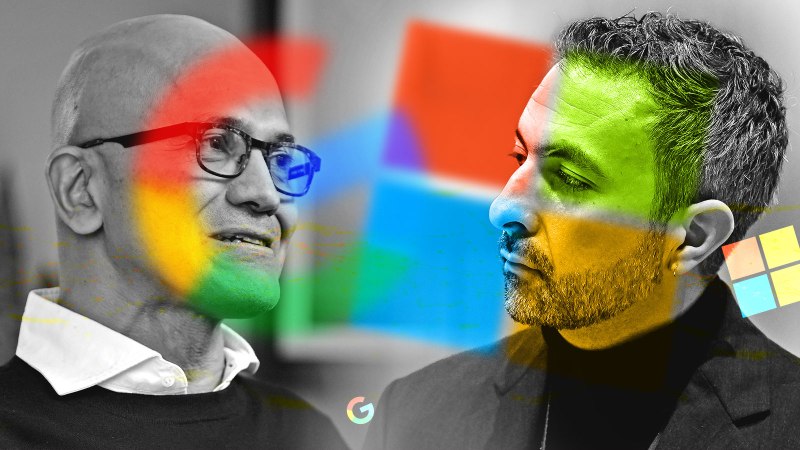

This week Alphabet, the owner of Google, a fellow digital advertising heavyweight, posted results that disappointed Wall Street, after holiday season sales were below expectations.

“This was one of the most impressive quarters intrinsically and versus expectations,” Mark Mahaney, an analyst at Evercore, an investment bank advisory firm, said of Meta’s results.

Shares in the company, which is based in California and was founded in 2004, rose by $55.88, or 14.1 per cent, to $450.78 in late trading, lifting its value to $1 trillion.

Improvements to the social media business have made shareholders more tolerant of Meta’s undiminished spending, with huge investments in “metaverse” technologies and its artificial intelligence infrastructure. Its recovery has been aided by a rebound in user growth and digital ad sales. It has also more than 21,000 employees since late 2022.

“Meta ended 2023 on an extremely strong note, with revenue soaring above analyst expectations,” Debra Aho Williamson, a tech analyst at eMarketer, said. “The company can talk all it wants to about artificial intelligence and the metaverse, but it’s still a social media company that gets nearly all its revenue from advertising, and advertisers still clearly love Meta.”

The company’s metaverse-oriented Reality Labs division exceeded revenue expectations for the fourth quarter, posting record sales of $1.1 billion from “strong sales” of its Quest device over the holiday season, Mark Zuckerberg, chief executive and co-founder of the company, said after the report. Investors had been expecting $804 million.

“We’ve made a lot of progress on our vision for advancing AI and the metaverse,” Zuckerberg said.Meta said that it still expected operating losses for Reality Labs to “increase meaningfully” as it invests further in augmented and virtual reality.