Microsoft flexes its tentacles to reach the brains behind DeepMind

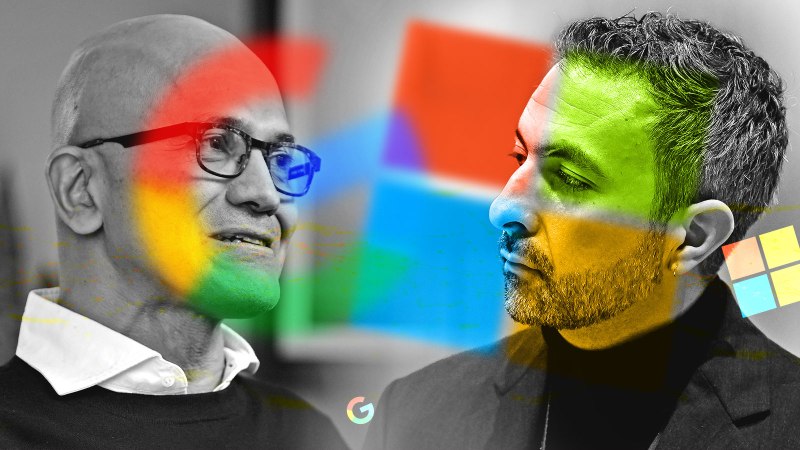

It’s not often that a job move creates such interest. When Microsoft announced that it had poached Mustafa Suleyman, one of the brains behind Google’s DeepMind, to leave his latest AI startup to run Microsoft’s newly created AI division, there were audible gasps. Not only that, he was bringing much of his team from Inflection AI with him.

The veteran Silicon Valley investor Marc Andreessen simply posted “what” on Twitter/X. Even Jeremy Hunt, the chancellor, had a view: “Quite a thing to see the top roles in AI, both at DeepMind/Google and Microsoft go to extraordinary British talent — helping us realise our ambition to be the world’s next Silicon Valley.”

In a nod to the commercial nous of Satya Nadella, Microsoft’s energetic chief executive, one X user remarked “Satya is the godfather”, next to a picture of Robert De Niro with the caption: “I’ll make you an offer you can’t refuse.”

Perhaps the most perceptive comment came from another user who said: “How come u don’t call it mAIcrosoft?” A rebrand that would certainly encapsulate how the tech group is jumping into the developing technology with both feet.

Suleyman’s defection is being hailed as a coup for Microsoft and yet another AI chess move from Nadella, who is systematically gathering up some of the world’s top artificial intelligence talent from making investments and alliances with start-ups and people.

As Brad Smith, Microsoft’s president, said at this year’s Mobile World Congress: “We need to advance a broad array of AI partnerships. Innovation and competition will require an extensive array of similar support for proprietary and open-source AI models, large and small. We have also invested in a broad range of other diverse generative AI startups. In some instances, those investments have provided seed funding to finance day-to-day operations. In other instances, those investments have been more focused on paying the expenses for the use of the computational infrastructure needed to train and deploy generative AI models and applications.”

Far from the boring creator of Excel spreadsheets and Word, Microsoft is trying to stay one step ahead of the competition by boldly going into the world of AI, making sure that every corner of the tech is linked back to the mothership. The concept of “mAIcrosoft” feels spot on.

Microsoft’s AI advances helped to lift the group’s second-quarter revenues to $62 billion. The group has been rolling out Copilot, an AI tool for businesses embedded in its popular software products, that can draft emails, make presentations and send out meeting transcripts.

Early sales were reflected in the company’s commercial sales of Office software, where revenue grew by 17 per cent. Analysts at Wedbush have said that the technology could increase Microsoft’s revenues by about $25 billion.

What does this mean for Inflection AI, which raised more than $1.3 billion in 2023, including from Microsoft? Only a week ago it launched Inflection 2.5, a close competitor to OpenAI’s latest ChatGPT model, and reported having one million daily active users.

The investors “will have a good outcome today and I anticipate good future upside”, according to Reid Hoffman, Inflection AI’s co-founder and the founder of LinkedIn, which was bought by Microsoft in 2016. Hoffman also sits on Microsoft’s board.

Microsoft has paid Inflection $650 million, mainly for a licence fee to make its models available on its Azure cloud service.

Tony Wang, managing partner at 500 Global, a venture capital company with $2.4 billion under management, said: “My initial reaction was shock … the fact that Mustafa left his company on a rising trajectory to join a competitor incumbent broke all models of pattern matching.” He called it “an acquisition of Inflection without having to go through regulatory approval”.

Many regard it as an “acqui-hire”; hiring a talented bunch of employees as a way of buying a business without some of the hassles, not to mention regulatory scrutiny, of an acquisition.

Nonetheless, Inflection lives on without them. “@InflectionAI will continue on its mission under a new CEO, and look to reach more people than ever by making its API widely available to developers and businesses the world over,” Suleyman said.

Microsoft’s closest relationship within the AI start-up scene is with the ChatGPT maker OpenAI. It has poured $13 billion into the business, receiving an undisclosed profit share, thought to be 49 per cent. In return, it gives OpenAI access to its vast cloud infrastructure, the power it needs to train its compute-hungry large language models that sit behind its chatbot.

Something similar to this “acqui-hire” almost happened between Microsoft and OpenAI last year, when Sam Altman was pushed out of the business and then brought back over the course of a fraught weekend. Nadella offered him a role within Microsoft and offered to take as many of the team with him as wanted to come.

Altman, OpenAI’s chief executive and co-founder, was by Nadella’s side throughout this year’s Davos conference as the two were feted for blazing a trail in AI, bringing it to the consumer market through Microsoft’s products.

Some believe this kind of manoeuvre from Microsoft was a takeover in all but name.

All these frenzied links between Big Tech and the AI world have attracted the attention of regulators. In the US, the Federal Trade Commission (FTC) has called on Alphabet, Amazon and Microsoft to supply information on their investments and partnerships with OpenAI and its rival Anthropic, backed by Google and Amazon.

In the UK, the competition authority is also investigating whether the relationship between Microsoft and OpenAI could be considered a merger. The European Commission is looking into whether Microsoft’s multibillion-dollar investment in OpenAI represents a breach of its antitrust rules.

The Inflection deal may not just be about people, it could also be about its chips or computing power.

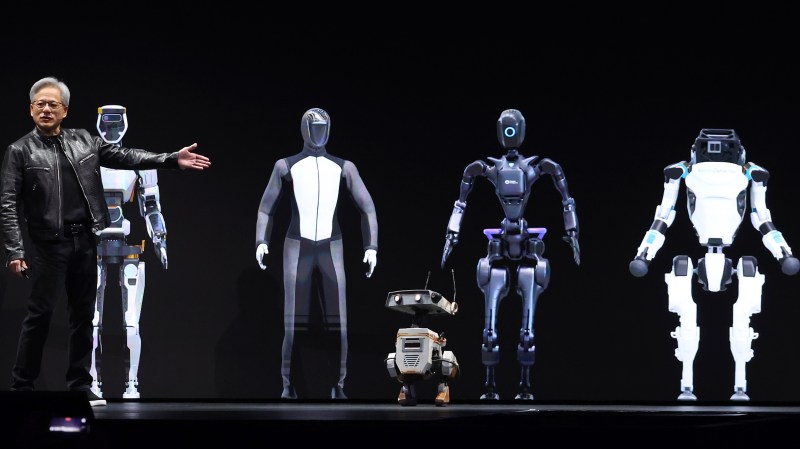

According to the latest annual State of AI report, Inflection owns 22,000 of Nvidia’s powerful H100 chips, more than Oracle or Tesla, which the report said have 16,000 and 10,000 respectively as of last month. In 2023 Inflection announced that it was “building one of the largest computing clusters in the world” as part of a tie-up with CoreWeave and Nvidia.

These will stay with the start-up for the moment, although it is not clear what will happen to them in future. A spokesman for Inflection said: “Inflection has a contract with CoreWeave for the cluster and that contract is still in place. At some point in the future it may or may not be amended, which may or may not release the cluster to be used by someone else. But that’s not a decision that’s been taken.”

In the global arms race for the compute that powers AI, these much-in-demand graphics processing units are highly valued. They are “harder to buy than drugs”, as Elon Musk quipped last year.

Even though he was no longer at Google DeepMind when he made the jump, Microsoft bringing in Suleyman, a former member of its rival’s AI business, is symbolic of the intensity of the AI arms race at the heart of Silicon Valley.